159.8K

Downloads

76

Episodes

Join us for a digest of the latest research, analysis and insights on the relationships between environmental social and corporate governance issues and global business, finance and society. In each episode, hear from experts sharing their insights on how institutional investors can identify and mitigate risks related to ESG factors, but also leverage opportunities in sustainable investment and debt capital markets. This is ESG in Conversation.

Episodes

Wednesday Jun 22, 2022

Wednesday Jun 22, 2022

Episode Summary

Hosts

- Nicholas Gandolfo, Director, Corporate Solutions

- Marika Stocker, Senior Manager, Corporate Solutions

In this episode, Nick and Marika highlight recent developments in the sustainable finance market. They note that the market is coming off a banner year — over US$1 trillion in volumes overall in 2021 —and shed light on the deals and transactions contributing to market growth. They also answer audience questions, sharing Sustainalytics’ take on where nuclear energy and mining could fit in sustainable finance. Be sure to submit your questions to podcast@sustainalytics.com.

Could Geopolitical Conflict Spur Adoption of Renewables?

Discussion around the adoption of renewable energy is growing given the impact of Russia’s war in Ukraine and other global conflicts on oil and gas exports and imports. These geopolitical conflicts have exposed the risks of overreliance on producers and certain types of energy. One possible reaction to the disrupted and restricted energy supply from Russia is an acceleration of renewables deployment across Europe. This would hopefully spur broader adoption within the region and beyond.

Just Adaptation: Helping Nations Build Resilience to Climate Change

As governments consider what it takes to transition to a low-carbon economy, the concept of just adaptation is also being discussed. Stakeholders are looking beyond a just transition and examining the inequity between developed and developing countries in their abilities to adapt to climate change. Developing nations are more likely to be affected and have fewer resources to adequately prepare their populations and natural environments despite contributing less to the drivers of climate change compared to developed nations. Nick notes that there is potential to use sustainable finance to balance this inequity. Hopefully, we will see an evolution in sustainable finance issuances from sovereigns and corporates, with use of proceeds and KPIs that tap into some of these issues.

Real ESG Accountability: Tying Your Company’s ESG Performance to Leadership Compensation

Stakeholders are increasing pressure on companies to tie executive compensation to ESG performance for enhanced accountability and transparency. Download our latest ebook to discover how ESG incentive plans can align executive action with strategic priorities.

Key Moments

| 0:00:52 | Market overview |

| 0:01:22 | CBI report 2021 review |

| 0:02:21 | EF Article — GB market growth 100-fold in 10 years |

| 0:02:50 | IPCC reports |

| 0:03:35 | IFC — Guide to issuing green bonds |

| 0:03:40 | Ukraine conflict and social bonds |

| 0:04:41 | Fintech and climate tech |

| 0:05:11 | Just transition and just adaptation |

| 0:06:13 | Social taxonomy |

| 0:06:41 | EU Green Bond Standards |

| 0:07:02 | Financed emissions |

| 0:07:36 | ESG and derivatives |

| 0:07:59 | From CBI — webinar on China and new criteria for chemicals sector |

| 0:08:36 | SLB overview |

| 0:14:14 | SLL overview |

| 0:18:10 | Audience questions |

| 0:26:09 | Green bonds overview |

| 0:30:47 | Green loans overview |

| 0:32:02 | Social bonds and loans overview |

| 0:33:42 | Labeled products overview |

| 0:34:27 | Transition bonds overview |

| 0:35:37 | Regulatory and country updates |

Links to Select Resources

- Climate Bonds Initiative – Sustainable Debt Global State of the Market 2021

- Environmental Finance – “Dramatic” 100-Fold Green Finance Growth Over Last Decade

- Environmental Finance – IFC publishes step-by-step green bond issuance guide

- GreenBiz – Will Russia’s War Spur Europe to Move on Green Energy?

- Fintech Futures – ESG and Fintechs: How Firms are Benefiting from an ESG Focus

- Environmental Finance – EU GBS 'may be a step backward' for green bond impact reporting

- IFR – Financial Markets Wrestle with Scope 3 Requirements

- Deloitte – Sustainable Finance Magazine (page 10)

- ISDA – Pre-AGM Symposium: ESG and the Role on Derivatives

- Climate Bonds Initiative – Green Bond China Investor Survey 2022

- Climate Bonds Initiative – Basic Chemicals Criteria

- Sustainalytics SPOs:

- Pernod Ricard Sustainability-Linked Framework Second-Party Opinion

- JAB Holdings Sustainability-Linked Bond Framework

- EU SURE Social Bond Framework Second-Party Opinion

- OP Mortgage Bank Annual Review (2022)

- Green Financing Framework for Jabil Second-Party Opinion

- Equinix Green Finance Framework Second-Party Opinion

Monday Jun 06, 2022

Monday Jun 06, 2022

Episode Summary

On this episode:

- Melissa Chase, Content Marketing Manager, Corporate Solutions

- Toshi Batbuyan, ESG Research Senior Analyst, Oil and Gas Sector Research

- Frances Fairhead, ESG Research Senior Analyst, Mining Sector Research

- Shilpi Singh, Corporate Solutions Director

With rising demand from investors and other key stakeholders to address the environmental, social and governance issues they face, companies are considering how they can effectively manage their most material ESG issues. In this episode, featuring insights from our recent webinar on the topic, we examine some of the key ESG issues facing companies in industries with the highest average ESG risk and explore how companies can manage those issues effectively.

Companies with lower ESG risk can also learn important lessons in ESG risk management from those in high ESG risk industries. Many of these issues are common across industries, giving companies an opportunity to learn more about managing ESG risk exposure from their peers.

For more, watch the on-demand webinar or download the ebook that inspired the session, Understanding Materiality: Lessons from Industries With High ESG Risk.

Key Moments

|

0:01:38 |

Episode overview |

|

0:03:04 |

Explanation of how the ESG Risk Ratings are assessed |

|

0:05:18 |

Overview of the industrial conglomerates industry |

|

0:06:20 |

Overview of the steel industry |

|

0:07:10 |

Overview of the diversified metals and precious metals industries |

|

0:08:55 |

Overview of the oil and gas producers industry |

|

0:10:53 |

Insights on how to manage material ESG issues |

|

0:11:27 |

Environmental issues |

|

0:12:45 |

Business ethics |

|

0:13:47 |

Community relations |

|

0:15:01 |

Occupational health and safety |

|

0:15:33 |

Industry and international standards and guidance |

|

0:17:00 |

The importance of ESG target setting, reporting and transparency |

|

0:20:03 |

Importance of having a corporate ESG strategy |

|

0:20:49 |

Takeaways from the webinar |

To read the full transcript, please visit our website.

Thursday May 19, 2022

Thursday May 19, 2022

Episode Summary

Hosts

- Nicholas Gandolfo, Director, Corporate Solutions

- Aditi Bhatia, Regional Sales Manager, Corporate Solutions

In our latest episode, we have a round-up of recent developments in the global sustainable finance market. From innovative instruments for financing conservation efforts to growing ESG activity in the private equity space, to a new taxonomy for social bonds, our hosts Nick and Aditi have you covered. Check out the highlights below or listen to the full episode wherever you stream your podcasts.

Social Bonds in the Spotlight

There have been some key market developments in recent months. The Platform on Sustainable Finance published its report on the EU’s Social Taxonomy providing clarification on the types of investments that would be considered socially sustainable and proposing a structure for a social taxonomy. Overall activity in social bonds issuance appears to be declining compared to recent years. This is partly due to market stabilization following a surge of issuance during the height of the pandemic and social use of proceeds frequently being included in sustainability bonds frameworks which cover both green and social projects. However, there is growing diversity in the types of social factors being addressed as more issuances come to market related to matters around gender, race, and LGBTQ issues.

Rhino Bonds: Market Innovation Support Conservation Efforts

This new form of social impact bond was recently issued by the World Bank. The USD 150 million “rhino bond” or Wildlife Conservation Bond will help to fund conservation efforts for the black rhino population in South Africa. The Rhino Bond channels investments to achieve specific conservation outcomes with proceeds being used to help staff in national parks battle poachers and improve conditions for the animals. This bond offers a new model to finance conservation efforts by directly linking the outcome of rhino conservation to investor payouts, and investment success. You can read more about the bond issuance here.

Recommended Reading

Nick once again provides a list of his recommendations for reports on ESG, sustainable finance, climate change, and transition issues.

- ACT Transition Methodologies

- Climate Bonds Initiative – Green Bond Pricing in the Primary Market

- Climate Bonds Initiative – Global Green Taxonomy Development, Alignment, and Implementation

- Taskforce on Nature-related Financial Disclosures – TNFD Nature-Related Risk & Opportunity Management and Disclosure Framework – beta v0.1

- GRI – Sector Standard for Coal

- IPCC – Sixth Assessment Report

- Environmental Finance – Sustainability-Linked Bonds and Loans KPIs

- Luxembourg Stock Exchange – Trends and Characteristics of the Sustainability-Linked Bond Market

- Science-Based Targets – Guidance for Financial Institutions

- Platform on Sustainable Finance – Final Report on Social Taxonomy

Gain Insight on the Material ESG Issues Companies Face and Approaches for Effective Management

Are you aware of the material ESG issues facing your company? Do you know how to effectively address them? Watch our recent webinar, Addressing Key Corporate ESG Issues: Lessons From Industries With High ESG Risk. Our panel of ESG sector analysts provide insight on the material ESG issues facing five high risk sectors. Learn how companies with high exposure to ESG risk manage their most material issues and how you can too.

Key Moments

|

0:00:46 |

Market overview |

|

0:01:11 |

Ongoing market growth |

|

0:01:14 |

Sustainable bonds in emerging markets |

|

0:01:24 |

ESG performance and bond premiums |

|

0:01:49 |

Social bond market under threat? |

|

0:02:46 |

ESG activity in private equity |

|

0:03:07 |

Implications for Ukraine conflict on green transition |

|

0:03:49 |

Prevalence of sovereigns in ESG transactions |

|

0:04:05 |

Sustainable securitization |

|

0:04:44 |

Just transition |

|

0:05:23 |

Gender-themed social bonds |

|

0:05:56 |

Continuing conversation around greenwashing |

|

0:06:31 |

Big pharma going green |

|

0:07:06 |

Rhino bond |

|

0:08:32 |

SBTi – public consultation on cement |

|

0:08:48 |

Social Taxonomy Report |

|

0:10:00 |

ACT Transition Methodologies |

|

0:10:07 |

CBI bond pricing report |

|

0:10:13 |

CBI report on taxonomies |

|

0:10:29 |

TNFD beta report |

|

0:10:57 |

GRI sector standard for coal |

|

0:11:15 |

IPCC assessment report |

|

0:11:33 |

Environmental Finance SLL/ SLB metrics report |

|

0:12:00 |

SLB overview |

|

0:15:52 |

SLL overview |

|

0:18:02 |

Audience questions |

|

0:22:05 |

Green bonds overview |

|

0:28:16 |

Green loans overview |

|

0:29:33 |

Social bonds overview |

|

0:31:45 |

Labeled products, transition, and regulatory overview |

Links to Select Resources

- International Monetary Funds – Sustainable Finance in Emerging Markets is Enjoying Rapid Growth, But May Bring Risks

- Funds Europe – Stronger Ranked ESG Companies Receive Market Premium

- PitchBook – On the podcast: The ABCs of ESG for PE Firms

- Global Capital – EBA’s Sustainable Securitization Ideas ‘Level the playing field’, says Afme

- International Banker – The Role of Banking in a Just Energy Transition

- Impact Alpha – Social Bonds Direct Proceeds to Racial Equity as the “S” Gains Prominence in ESG

- Sustainalytics SPOs:

- Government of Chile Sustainability-Linked Bond Framework Second Party Opinion

- L’Oréal Sustainability-Linked Financing Framework Second Party Opinion

- Government of Canada Green Bond Framework Second Party Opinion

- Pepper Money Limited Green Bond Framework Second-Party Opinion

- TAG Immobilien AG Sustainable Finance Framework Second-Party Opinion

- Mosaic Solar Green Use of Proceeds Securitized Bond

- New York Power Authority Green Bond Pre-Issuance Review

- Marui Group Social Bond Framework Second-Party Opinion

Wednesday Apr 20, 2022

Setting Up Your Corporate ESG Program for Success and Avoiding Early Obstacles

Wednesday Apr 20, 2022

Wednesday Apr 20, 2022

Episode Summary

Host: Adam Gorley, Marketing Manager, Corporate Solutions

Guest: Shilpi Singh, Director, Corporate Solutions

In this special episode of the Sustainalytics Podcast, Adam and Shilpi discuss important considerations for any organization starting an ESG program and how to set up your program for success. You’ll hear about gaining leadership buy-in, planning and resourcing your program, meeting reporting requirements, communicating your progress with stakeholders, and the role of third parties, plus potential obstacles you can avoid.

What Successful Corporate ESG Programs Require

As with most projects, good planning and commitment are strong drivers of a successful ESG program. To make the most of their effort, companies starting an ESG program need to have a clear understanding of the ESG issues that affect them, what their impacts are, and how they relate to the business strategy. With this knowledge, a company can effectively address the issues that are most material to the business and confidently and transparently communicate its ESG activities with stakeholders.

Can You DIY ESG?

Can a firm plan and implement an ESG program on its own — that is, without guidance from an external ESG specialist? Yes, says Shilpi, but it’s not for every company. No third party knows your business like you, your team, and your stakeholders, so there is a lot of valuable ESG information that companies can gather and analyze — if you have the resources. At the same time, ESG specialists have a lot to offer in terms of understanding what actions to prioritize, competitive insights, and credibility.

Read Our New eBook, Getting Started With ESG: What Every Company Needs to Know

|

Download our practical guide to starting a corporate ESG strategy for additional details on the considerations we talked about in the podcast. Discover key action steps for gaining top leadership buy-in, planning and resourcing your program, developing your strategy, and reporting and communicating your progress. |

Monday Apr 18, 2022

Monday Apr 18, 2022

Episode Summary

Hosts

- Nicholas Gandolfo, Director, Corporate Solutions

- Marika Stocker, Senior Manager, Corporate Solutions

In this episode, Nick and Marika welcome special guest Simon Vacklen, Senior Manager with Sustainalytics’ Corporate Solutions to discuss impact reporting for use of proceed bonds. As more funds are allocated to labeled and sustainability-linked bonds, there is growing demand from investors to understand and measure the positive impact of the assets and projects financed. Simon notes that while the current focus is on environmental and climate impacts, such as the amount of greenhouse gases avoided, the market is also looking toward ways to effectively quantify positive social impact.

Sustainalytics Launches Impact Reporting for Bonds and Loans

To support companies and investors looking for opportunities to analyze and investigate the impact of their projects and investments, Sustainalytics now offers Impact Reports for Bonds and Loans. Available for pre- and post-issuance assessments, the reports provide issuers with a credible and independent analysis of the impacts both expected and achieved by financed projects.

Climate Bonds Standard Shares Criteria for Hard-to-Abate Sectors

The Climate Bonds Standard announced that it will be expanding to include criteria and certification for credible transition for heavy industrial sectors, starting with the cement industry. The cement criteria will provide science-based requirements which identify when investment and activity in the sector are aligned with the transition to the Paris Agreement objectives. Throughout 2022, the Climate Bonds Standard plans to expand its criteria to support the low-carbon transition of other heavy-emitting sectors such as basic chemicals and steel.

Download Our New eBook, Understanding Materiality: Lessons From Industries With High ESG Risk

|

The business case for addressing material ESG issues is clear: the effective management of ESG risks can contribute to superior long-term enterprise value. Sustainalytics Corporate Solutions can help you better understand how ESG risks can impact your operations. Download our analysis of the five industries with the highest ESG risk to learn how companies in any industry can find opportunities for improving ESG risk management. |

Key Moments

|

0:01:10 |

Market news |

|

0:01:52 |

AFME - ESG Finance Report 2021 |

|

0:02:23 |

Green bond market forecast for 2022 and beyond |

|

0:02:57 |

Nuclear and gas debate in the EU green taxonomy |

|

0:03:18 |

Environmental Finance Sustainable Bonds Insight 2022 |

|

0:03:57 |

Boom in sovereign green issuances |

|

0:04:09 |

IFC updates guidelines for blue bonds |

|

0:04:18 |

Transition bond debates continue |

|

0:04:34 |

Ongoing discussion around mapping Scope 3 emissions |

|

0:05:01 |

Outlook on scaling up carbon markets |

|

0:05:35 |

ISSB and the harmonization of disclosures |

|

0:06:13 |

Challenge directed at SBTi process |

|

0:06:59 |

EU Green Bond Standards |

|

0:07:04 |

CBI report on premiums for green and social bonds |

|

0:07:52 |

CBI China Transition Report |

|

0:08:06 |

Climate Bonds Standard transition criteria for cement sector |

|

0:08:28 |

Special Guest - Simon Vacklen discusses impact reporting for green and social bonds |

|

0:16:45 |

SLB overview |

|

0:21:03 |

SLL overview |

|

0:25:25 |

Audience questions |

|

0:30:38 |

Green bonds overview |

|

0:34:13 |

Green loans overview |

|

0:35:49 |

Social bonds and loan overview |

|

0:36:39 |

Labeled products overview |

|

0:38:25 |

Transition bond and regulatory news |

Links to Select Resources

- AFME - ESG Finance Q4 and Full Year 2021 - European Sustainable Finance

- Bloomberg - Emerging ESG Bond Boom Puts World on Path to Sell $1.8 Trillion

- DW - European Commission declares nuclear and gas to be green

- Environmental Finance – Sustainable Bonds Insight 2022

- International Finance Corporation – Guidelines for Blue Finance

- South China Morning Post - Sustainable finance: why transition bonds and loans are not popular even as demand for green and sustainable products is growing

- Environmental Finance – The Changing Shape of the Carbon Markets

- BBC News - Climate Change: Top Companies Exaggerating Their Progress - Study

- Official Monetary and Financial Institutions Forum - Greenium set to stay, say sovereign debt issuers

- Climate Bonds Initiative – Transition Finance in China

- Sustainalytics – Maximum Impact: How Bond Impact Reporting Can Improve Corporate Decision Making

- Sustainalytics SPOs:

- Fabbrica Italiana Sintetici Sustainability-Linked Bond Second-Party Opinion

- Cellnex Sustainability-Linked Financing Framework Second-Party Opinion

- Sparebanken Sør Green and Sustainability Bond Framework Second-Party Opinion

- Central American Bank for Economic Integration Social Bond Annual Review

- iA Financial Group Sustainability Bond Framework Second-Party Opinion

Tuesday Mar 22, 2022

Tuesday Mar 22, 2022

Episode Summary

Hosts

- Nicholas Gandolfo, Director, Corporate Solutions

- Aditi Bhatia, Regional Sales Manager, Corporate Solutions

In this episode, hosts Nick and Aditi discuss notable trends and deals in sustainable finance – from rapid market growth, to increasing diversification of products, new taxonomies, sovereign green bonds and sustainability-linked bonds, impact accounting and reporting, and much more. Nick also tackles audience questions, offering some valuable insight on group frameworks and Sustainalytics’ approach to supporting transition finance.

Rapid Growth in Sustainable Finance

2021 saw incredible growth in sustainable finance and ESG assets under management (AUM) are projected to reach US$50 trillion by 2025 and make up one-third of global AUM. Sustainable bonds already made up 10% of global debt issued in 2021, with US$1 trillion issued for the first time and a 40% increase over 2020. And 2022 is showing no signs of slowing down, with a hot start to the year and good momentum looking forward.

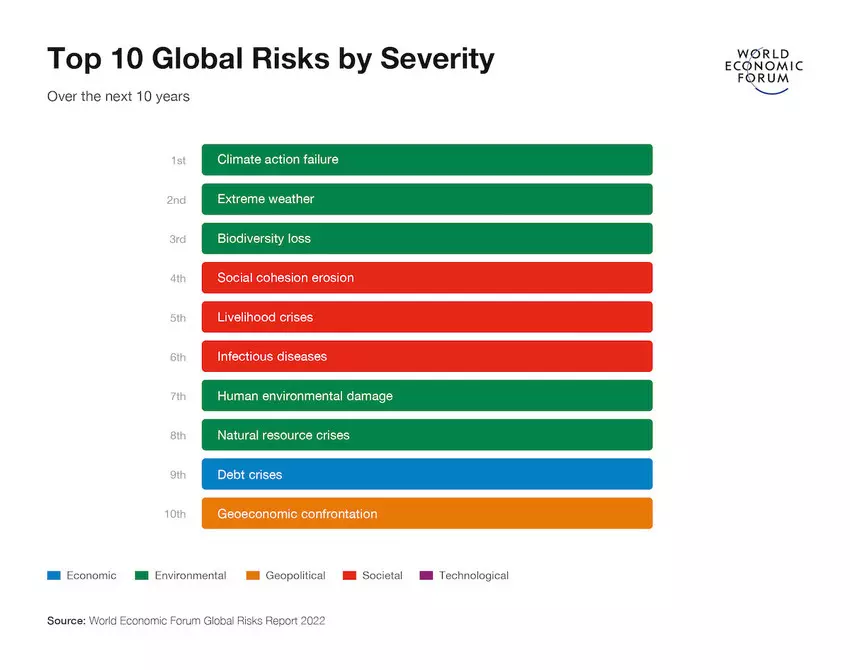

World Economic Fund Risk Report 2022

Of the WEF’s top ten global risks by severity, five are environmental issues and the top three directly relate to climate change. View the report here. Maybe it’s no surprise that this theme is carried forward from the previous risk report, but it highlights the continued importance of funding for projects that address climate risk.

Download Our New eBook Getting Started With ESG: What Every Company Needs to Know

As more and more companies are thinking about incorporating ESG considerations into their strategies, Sustainalytics Corporate Solutions wants to ensure they start off on the right foot. Download our practical guide to starting a corporate ESG strategy. Discover key issues that could affect your company, the benefits of action, and the risks of inaction.

Key Moments

|

Market news |

|

|

02:17 |

Hot start to the year: looking for $1tn ESG investment in 2022 |

|

03:31 |

Big year for taxonomies? ASEAN, Korea, Indonesia, plus EU changes |

|

03:58 |

WEF Risk Report: top risks climate-related |

|

05:10 |

ESG risk ratings scrutiny – usefulness and robustness |

|

05:45 |

Fashion industry financing decarbonization and scope 3 emissions |

|

06:20 |

Impact accounting |

|

07:15 |

Nuclear & Gas and the EU Taxonomy |

|

07:52 |

John Holland Sustainability Linked Bank Guarantee (Australia) |

|

08:32 |

COVID recovery and Build Back Better |

|

09:02 |

CBI report: Thailand infrastructure |

|

09:25 |

World Bank report: sovereign SLB KPIs |

|

09:51 |

IEA report: digitization as enabler for transition |

|

10:20 |

Environmental Finance report: Green Bond Impact Reporting |

|

Green bonds overview |

|

|

11:25 |

Sovereigns: Egypt, Cyprus, Qatar, Denmark, Uruguay |

|

12:00 |

Banks |

|

13:40 |

Lots of activity and diversification in India |

|

14:50 |

Social bonds to fund affordable housing, microfinance, employment |

|

Green loans overview |

|

|

16:15 |

Renewables |

|

16:40 |

Property |

|

17:05 |

Industrial machinery: sustainable water management |

|

SLB overview |

|

|

18:10 |

Coal terminals: scope 3 emissions and transition plans |

|

19:02 |

Construction: reducing scope 1 and 2 carbon emissions |

|

19:38 |

Private equity: coverage approach, science-based targets |

|

20:40 |

Telecom: scope 1, 2 and 3 reductions |

|

22:55 |

Chemicals: scope 1 and 2, recycling, SBT, Transition Pathway Initiative, IEA |

|

Listener questions |

|

|

24:20 |

Q: Can a group framework cover all the entities in the group? |

|

26:13 |

Q: How does Sustainalytics sign off on transition and what’s our approach? |

|

SLLs |

|

|

29:15 |

Sector activity: shipping, pulp and paper, finance, property, retail, telecom, rail, IT, manufacturing, chemicals, construction, and more |

|

Labeled products overview |

|

|

32:30 |

Saudi Arabia: green deposits |

|

32:40 |

Insurance connected to climate |

|

32:58 |

Trade finance and solar loans |

|

Transition finance overview |

|

|

33:28 |

Hydrogen, mining, oil companies, McKinsey report, Japan |

|

34:50 |

Countries and regulations |

Links to Select Resources

- Banking Exchange: Global ESG Assets to Hit $50 Trillion by 2025

- Asian Investor: Sustainable Finance Bonds Make Up 10% Of Global Debt Issued in 2021

- World Economic Fund: Global Risks Report 2022

- Morningstar: ESG Ratings Are Bottom-Line Focused, but Have Broader Impacts

- Environmental Finance: 'Impact Accounting' Bodies Launch Survey Of Existing Approaches

- Climate Bonds Initiative: Keeping the Momentum: China Introduces Innovative Labels Into Domestic Market

- Environmental Finance: Impact report quality deters green bond fund investors

- Bloomberg: Global Issuers Land in Canada as Nation’s Banks Fund Abroad

- Sustainalytics SPOs:

- Danske Bank Group Green Bond Framework

- Banco do Brasil Sustainable Finance Framework

- FONPLATA Sustainable Debt Framework

- Northland Power Green Financing Framework

- Sumitomo Mitsui Banking Corporation's Green Bond Framework

- ICG Sustainability-Linked Bond Framework

- Cellnex Sustainability-Linked Financing Framework

- Coca-Cola İçecek A.Ş. Sustainability-Linked Bond Framework

- The Central America Bottling Corporation Sustainability-Linked Financing Framework

Friday Feb 25, 2022

Friday Feb 25, 2022

Episode Summary

Hosts

- Nicholas Gandolfo, Director, Corporate Solutions

- Marika Stocker, Senior Manager, Corporate Solutions

In this episode, Nick and Marika provide a run-down of notable deals in the sustainable finance market, from sovereigns issuing sustainable debt, to corporate activity in green and social bonds and loans, to the introduction of new products and structures. They also answer audience questions about the outlook for labeled transition bonds and possible biodiversity-related indicators for linked transactions.

A Premium for Social Bond Issuances?

While evidence of a premium for green bonds – or greenium – continues to emerge, a similar advantage is being seen for social bond issuances. According to research, compared with conventional bond equivalents, social bonds received a yield discount of around 12 basis points at issuance. The explosion of social bond issuance in response to the COVID-19 pandemic, and the oversubscription of social bonds are contributing to this social premium or “socium” found for some social bond issues.

Insight on Elements for a Just Transition

The World Benchmarking Alliance published a report examining the social elements of companies’ low carbon transition. The report assessed 180 companies across three sectors – oil and gas, electric utilities, and automotive – and found that the majority of high-emitting companies are not taking action to move toward a just transition. Other key findings suggest the people most at risk are left out of decision making; companies will need to reskill their workforce as part of their transition plans; companies are not using their influence to advocate for a just transition; and that a just transition needs to be underpinned by companies’ respect for human rights. Hopefully, we’ll see some of the findings from this report reflected in the performance indicators and use of proceeds of sustainable finance transactions going forward.

Download Our New eBook Getting Started With ESG : What Every Company Needs to Know

As more and more companies are thinking about incorporating ESG considerations into their strategies, Sustainalytics Corporate Solutions wants to ensure they start off on the right foot. Download our practical guide to starting a corporate ESG strategy. Discover key issues that could affect your company, the benefits of action, and the risks of inaction.

Key Moments

|

01:45 |

Market news |

|

02:09 |

Ideas for a "greener" holiday season |

|

02:26 |

December market volumes |

|

03:12 |

EU taxonomy discussions continue |

|

03:34 |

Steeper borrowing costs for sovereigns slow on climate |

|

04:21 |

Socium for social bonds |

|

05:01 |

World Benchmarking Alliance just transition corporate assessments |

|

05:49 |

Data centers and technology in green finance |

|

06:48 |

Using avoided emissions as targets |

|

06:54 |

SBTi report on private equity |

|

07:22 |

TPI report on pathways for other high-emitting sectors |

|

08:12 |

Green bonds overview |

|

13:23 |

Social bond overview |

|

15:03 |

Green loans overview |

|

16:19 |

SLB overview |

|

19:30 |

Audience questions |

|

24:22 |

SLL overview |

|

28:27 |

Labeled products, transition, and regulatory overview |

Links to Select Resources

- Bloomberg: Australia Seen Facing Steeper Borrowing Costs If Slow on Climate

- Environmental Finance: Social Bond 'Socium' Equivalent to One-Notch Credit Rating Upgrade

- GlobeNewswire: The Data Centre Dilemma: The Challenge of Becoming Carbon Neutral - A Look at Twenty Key Metro City Markets

- Treehugger: Volcano-Powered Bitcoin City Proposed for El Salvador

- Transition Pathways Initiative: Carbon Performance Assessment of Other Industrial Companies – Discussion Paper

- Environmental Finance: There Is a Market for Biodiversity - and It Is Expanding

- Wealth Briefing: ESG Phenomenon: Schroders Stokes "Avoided Emissions" Research; Jersey Finance

- Climate Bonds Initiative: Common Language on Financially-Supported Agricultural Green Development Report

Wednesday Feb 02, 2022

Wednesday Feb 02, 2022

Episode Summary

Hosts

- Nicholas Gandolfo, Director, Corporate Solutions

- Aditi Bhatia, Regional Sales Manager, Corporate Solutions

Your hosts Nick and Aditi showcase recent deals and transactions in the global sustainable debt and loan markets, share interesting reports, and highlight new labeled products and regulatory developments in this space.

Climate Promises Made, but What Do They Mean in Practice?

Reflecting on the outcomes from COP26, Nick and Aditi highlight some of the commitments made during the conference and what they could mean going forward. Many of the delegates, including some of the world’s largest polluters, made pledges to target net-zero emissions, curb deforestation, reduce methane emissions, and ‘phase down’ coal and fossil fuels.

The issue of what developed nations could and should do to support developing nations in building resilience against the impacts of climate change was also a hot topic. Some participants and observers were dissatisfied with the outcomes from COP26, and their disappointment was understandable. Though things may not be progressing as far or as quickly as needed, it is promising to see that these pressing climate issues continue to take center stage.

Bridging the Gender Gap Through Sustainable Finance

Among the recommended reading for this episode, a recent report from the International Capital Markets Association (ICMA), UN Women, and the International Finance Corporation (IFC) stands out. Bonds to Bridge the Gap: A Practitioner’s Guide to Using Sustainable Debt for Gender Equality, outlines how sustainable finance can help direct capital to reduce the financial and economic inequalities between women and men. The report offers case studies and examples of gender-related activities, targets, and key performance indicators for issuers to consider.

In a blog post from last year, Sustainalytics’ Ijeoma Madueke also discussed the idea of using gender lens investing and gender bonds to finance the empowerment and socio-economic advancement of women and girls globally. It’s clear that gender is a key issue that could, and should, be included in more sustainable finance transactions.

Key Moments

|

00:08 |

Introduction |

|

00:49 |

Market news |

|

01:10 |

Forecast for 2022 |

|

01:32 |

CBI Q3 report |

|

02:55 |

Post-COP 26 insights |

|

04:30 |

STBi - Net Zero Target Setting Mechanism |

|

05:04 |

World Bank report on ways to measure GDP |

|

05:33 |

ICMA, IFC, UN Women Report - Bonds to Bridge the Gender Gap |

|

06:04 |

Partnership for Carbon Accounting Financials (PCAF) report |

|

07:35 |

EU/China Common Ground Taxonomy |

|

07:52 |

IOSCO calling for ESG ratings regulation |

|

08:51 |

Green bonds overview |

|

14:22 |

Social bonds and loans overview |

|

15:05 |

Green loans overview |

|

16:11 |

SLB overview |

|

20:45 |

Audience questions |

|

24:25 |

SLL overview |

|

26:12 |

Labeled products overview |

|

27:35 |

Transition bonds overview |

|

29:06 |

Regulatory update |

Links to Select Resources

- Bloomberg – Modi Urges $1 Trillion to Help India’s Transition: COP26 Update

- Market Screener – SEB's The Green Bond Report: COP26 - a Qualified Success

- SBTi – The Net-Zero Standard

- The Age – Hitting Net-Zero Requires a Major Banking Shake-up

- Bloomberg – Nuclear Energy Generator Splits ESG Buyers With Green Bond

- Global Capital – EU, China Produce First Common Ground Taxonomy

- Responsible Investor – IOSCO: ESG Ratings and Data Need Regulatory Oversight to “Increase Trust”

- Sustainalytics SPOs:

- Frost CMBS 2021-1 Green Securitized Bond Framework Second-Party Opinion

- Barclays Capital Real Estate Inc. Social Bond Framework Second Party Opinion

- KPN Sustainability-Linked Finance Framework Second-Party Opinion

- Encevo S.A Green Schuldschein Framework Second Party Opinion

- Empresa Generadora de Electricidad Haina, S.A. Sustainability-Linked Financing Framework Second Party Opinion

Monday Jan 17, 2022

What’s Happening in Sustainable Finance: Innovation is the Name of the Game

Monday Jan 17, 2022

Monday Jan 17, 2022

Episode Summary

Hosts

- Nicholas Gandolfo, Director, Corporate Solutions

- Marika Stocker, Senior Manager, Corporate Solutions

The recurring theme in this episode’s round up of market developments is innovation! Nick also offers a list of recommended reading for the month (be prepared, it’s a long one) and concludes the tale of his encounter with an elephant in Bangladesh first mentioned in October’s episode.

Innovation is the Name of the Game in Sustainable Finance

The thread of innovation continues throughout sustainable finance – from green cryptocurrency to ESG derivatives, and relinked sustainability instruments (sustainability-linked bonds tied to sustainability-linked loans). Ultimately, it’s good to see the market continue to develop, but caution and scrutiny are needed to ensure that labeling and the increasing complexity of financial instruments don’t lead to greenwashing.

Greening of IPOs

On the heels of Allbirds’ initial public offering (IPO), for which Sustainalytics provided a corporate ESG assessment of the company, there are continuing discussions about the greening of IPOs. As the number of companies going public continues to rise, they are each looking for ways to signal to investors that they are a safe bet when it comes to managing material ESG risk and overall company management. Having their ESG or sustainability performance assessed by a third-party prior to their IPO is one way to do that. Watch this space as we see how this trend develops for new IPOs in 2022.

Recommended Reading

Nick runs down a list of reports and research focused on reducing emissions and transition finance.

- IEA – Tracking Report: Methane Emissions from Oil and Gas

- McKinsey – Curbing Methane Emissions: How Five Industries Can Counter a Major Climate Threat

- IEA – Global Hydrogen Review 2021

- IEA – An Energy Sector Roadmap to Carbon Neutrality in China

- Energy Transitions Commission – Keeping 1.5°C Alive: Actions for the 2020s

- HSCB – A Practitioner’s Guide to Net Zero for Banks

Key Moments

|

01:28 |

Market overview |

|

02:00 |

Greening of IPOs |

|

02:40 |

Google adds carbon data to flight info |

|

03:00 |

Green cryptocurrency |

|

03:32 |

EF conference - ESG Risk Ratings |

|

04:08 |

ESG derivatives |

|

04:46 |

Taxonomy report from Natixis |

|

05:11 |

Nuclear power in sustainable finance |

|

05:46 |

COP 26 highlights |

|

06:19 |

New in sustainability-linked finance: relinked SLB |

|

07:04 |

Biodiversity COP15 highlights |

|

07:31 |

Green industry unicorns |

|

08:03 |

Report recommendations: McKinsey & IEA methane reports |

|

08:40 |

CBI interactive data tool |

|

09:36 |

Green bonds overview |

|

15:10 |

Social bonds and loans overview |

|

21:21 |

Audience questions |

|

28:21 |

SLL overview |

|

30:53 |

Labeled products overview |

|

32:16 |

Transition finance overview |

|

33:30 |

Regulatory and country update |

Links to Select Resources

- Natixis – The New Geography of Taxonomies

- CBI Interactive Data Platform

- CBI – China Green Securitization State of the Market 2020

- Oilprice.com - EU’s Green Bond Debut Comes Out Swinging

- Forbes - Africa’s Seychelles Blue Bond Economy Inspires Belize

- Natural Gas World - Japan's Inpex Issues Its 1st Green Bonds

- Reuters - APICORP sells $750 million in debut green bonds

- Sustainalytics SPOs:

- Kvika Bank Green Financing Framework Second-Party Opinion

- The Famur Group Green Bond Framework Second-Party Opinion

- Autodesk Sustainability Financing Framework Second-Party Opinion

- OVS Group Sustainability-Linked Bond Framework Second-Party Opinion

- Autonom Sustainability-Linked Bond Framework Second-Party Opinion

Friday Nov 12, 2021

Friday Nov 12, 2021

Episode Summary

Hosts

- Nicholas Gandolfo, Director, Corporate Solutions

- Aditi Bhatia, Regional Sales Manager, Corporate Solutions

In this episode, Nick and Aditi discuss hot topics in sustainable finance. As the global green, social, sustainable, and sustainability-linked market continues to thrive, our hosts take note of the growing variety in use of proceeds, the debate around sustainability-linked bond penalties, and an eyebrow-raising new SLB issuance from Philip Morris International.

Sustainable Bond Market Reaches Half a Trillion in 2021

The Climate Bonds Initiative (CBI) reported that total labelled bond issuances (green, social, sustainability, transition and sustainability-linked) hit the half trillion mark in the first half of the year. That’s a 59% increase compared by 2020. For the green bond market specifically, CBI predicts annual volumes will reach $1 trillion by 2023. Other trends noted in the report are the continued growth of social and sustainability bonds, with social bond volumes quadrupling in H1 and sustainability bonds increasing 20%. The volume of sustainability-linked bonds also continued to soar in 2021. Transition bond issuances, on the other hand, are still struggling to gain traction.

Biodiversity on the Agenda

Nick notes that biodiversity continues to draw the attention of investors and issuers globally, with a growing number of reports and articles on the topic. This year also saw the UN Convention on Biological Diversity, or COP 15, wrapping up in China, and the launch of the Task Force on Nature-related Financial Disclosures over the summer. In the world of sustainable finance, we think biodiversity-related targets and use of proceeds will likely become more prominent within linked instruments and labeled bond issuances.

Webinar | ESG Risk Rating in APAC: Supporting the Corporate Sustainability Journey

Key Moments

| 00:02:50 | Market overview |

| 00:02:52 | CBI report on H1 2021 |

| 00:04:36 | Tier 2 subordinated debt |

| 00:05:28 | Greenwashing debate |

| 00:06:33 | SLBs and questions about penalties |

| 00:07:05 | Biodiversity |

| 00:08:02 | Nuclear |

| 00:09:18 | Philip Morris SLB |

| 00:10:06 | CBI report on Latin America |

| 00:10:44 | CBI annual conference |

| 00:11:53 | Green bonds overview |

| 00:21:35 | Social loans overview |

| 00:22:58 | Green loans overview |

| 00:24:23 | SLB overview |

| 00:27:57 | Audience questions |

| 00:30:09 | SLL overview |

| 00:31:47 | Transition bonds overview |

Links to Select Resources

-

Climate Bonds Initiative: Sustainable Debt Highlights H1 2021

-

Asian Investor: Do Fears of Greenwashing Outweigh the Evidence?

-

Environmental Finance: French Financial System 'Significantly Exposed' to Biodiversity Risk

-

European Scientist: Kazakhstan Banks on Nuclear Energy For Transition to Low-Carbon Future

-

Climate Bonds Initiative: Latin America & Caribbean: Sustainable Finance State of the Market 2021

-

Climate Bonds Initiative: Climate Bonds Conference21 Videos

-

Climate Bonds Initiative: Transition Finance for Transforming Companies discussion paper

-

Sustainalytics SPOs:

- Isle of Man Sustainability Finance Framework Second-Party Opinion

- Grupo Aeroportuario del Pacífico Green Financing Framework

- Verizon Green Financing Framework

- Axis Bank Sustainable Finance Framework Second-Party Opinion

- California Housing Finance Agency Social Bond Framework for the Purchase and Financing of Citibank, N.A. Affordable Housing Loans

- Bosam Social Bond Framework

- Rumo S.A. Sustainability-Linked Finance Framework

- Lilly Sustainability Bond Framework

- Vodafone Sustainable and Sustainability-Linked Finance Framework Second-Party Opinion

- CEMEX Sustainability-Linked Financing Framework Second-Party Opinion